Park model homes offer flexibility and comfort, but like any home, they can be affected by storms, accidents, water damage, or unexpected events. Knowing how to properly claim insurance for your park model can make the difference between a smooth recovery and a stressful, delayed process.

Because park models are often insured differently from traditional homes, many owners aren’t fully aware of the steps involved. This guide walks you through the insurance claim process for park models, explains what documentation you’ll need, and highlights common mistakes to avoid.

Step 1: Ensure Safety First

Before anything else, make sure the area is safe:

- Turn off electricity or gas if there’s visible damage

- Avoid entering the home if structural damage is suspected

- Prevent further damage if possible (temporary tarps, shutting off water)

Insurance companies expect homeowners to take reasonable steps to mitigate additional loss after an incident.

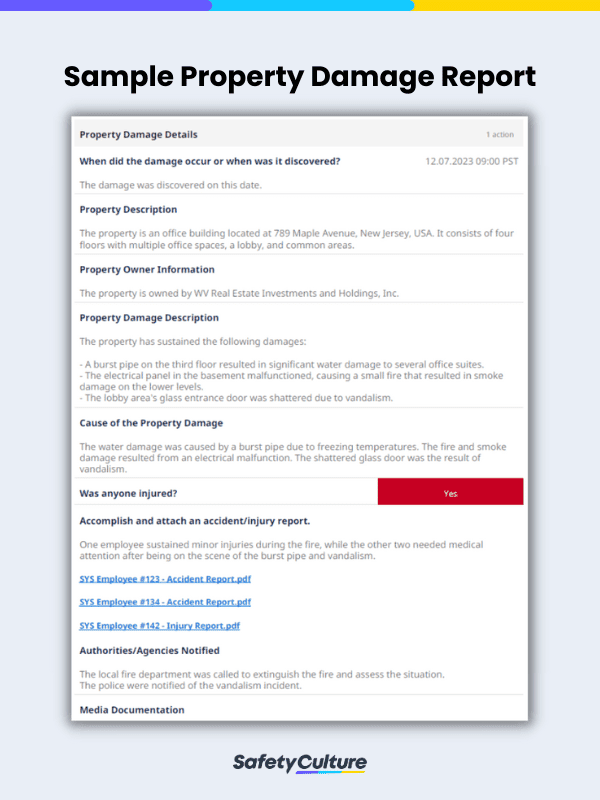

Step 2: Document the Damage Thoroughly

Documentation is the foundation of a successful insurance claim.

Be sure to:

- Take clear photos and videos of all damage (inside and out)

- Capture close-ups and wide shots

- Note the date, time, and cause of the incident

- Keep damaged items until advised otherwise

The more detailed your documentation, the smoother the claim process tends to be.

Step 3: Review Your Park Model Insurance Policy

Before filing the claim, review your policy to understand:

- What types of damage are covered (storm, fire, theft, water, etc.)

- Coverage limits and deductibles

- Exclusions or special conditions

Park models are often insured under RV, park model, or specialty dwelling policies, which can differ from standard homeowners insurance.

Step 4: Contact Your Insurance Provider Promptly

Most insurers require claims to be reported within a specific timeframe.

When you contact them, be prepared to provide:

- Policy number

- Description of the incident

- Date and location of damage

- Photos or videos (if available)

Delays in reporting can sometimes result in reduced coverage or claim denial, so it’s best to act quickly.

Step 5: Meet with the Insurance Adjuster

After filing, your insurer will usually assign an adjuster to inspect the damage.

During the inspection:

- Walk through the damage together

- Share your documentation

- Point out all affected areas, even minor ones

Tip: Take notes during the inspection and ask questions about next steps or timelines.

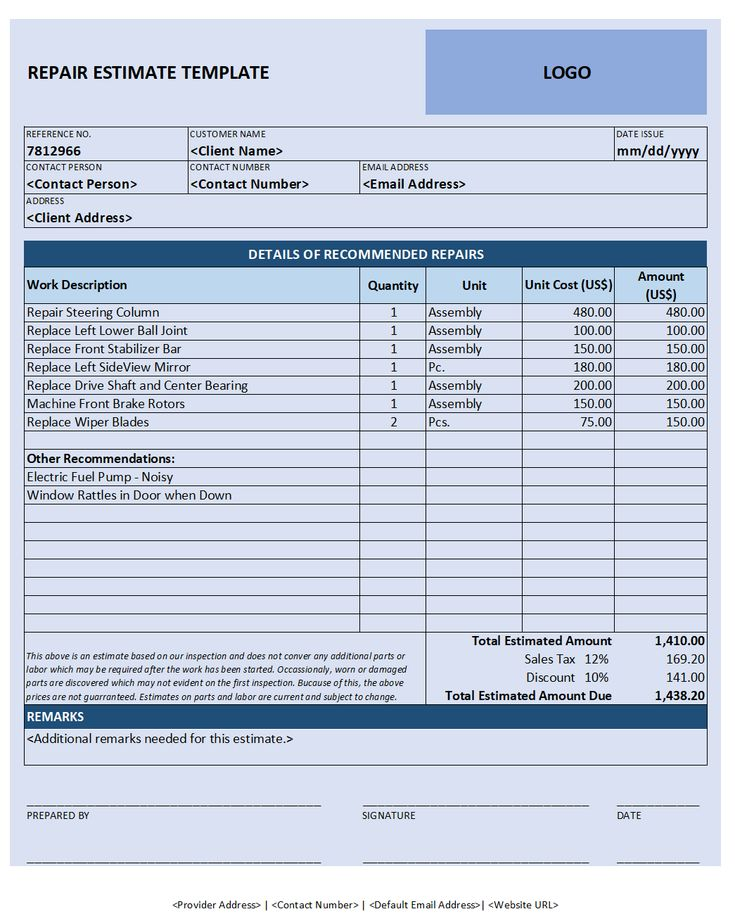

Step 6: Obtain Repair Estimates

Many insurance companies require:

- One or more repair estimates

- Quotes from licensed contractors

- Itemized breakdowns of labor and materials

If your park model was built by a reputable manufacturer like Phoenix Park Models, having original build details can help clarify material quality and replacement costs.

Explore durable construction options: Phoenix Park Models

Step 7: Claim Approval and Settlement

Once reviewed, the insurer will:

- Approve or deny the claim

- Issue payment based on coverage and deductibles

- Specify whether payment is for repairs or reimbursement

Some claims are paid in stages, especially if repairs take time.

Always review settlement details carefully before accepting payment.

Step 8: Complete Repairs and Keep Records

After approval:

- Complete repairs using licensed professionals

- Keep all invoices and receipts

- Document completed work with photos

These records protect you if there are follow-up questions or supplemental claims.

Common Mistakes to Avoid

Waiting too long to report damage

Throwing away damaged items too early

Under-documenting losses

Assuming all damage is covered

Not understanding deductibles or exclusions

Avoiding these pitfalls helps prevent unnecessary delays.

How Phoenix Park Models Helps Protect Your Investment

Park models from Phoenix Park Models are designed with:

- Durable materials

- Clear build documentation

- Recognized construction standards

This makes them easier to insure, repair, and restore after unexpected events, giving owners greater peace of mind.

Conclusion

Filing an insurance claim for your park model doesn’t have to be overwhelming. By acting quickly, documenting carefully, and understanding your policy, you can navigate the process with confidence and minimize downtime.

Whether your park model is a full-time residence, vacation home, or rental property, being prepared ensures you can recover faster and protect your investment.

FAQs

Is park model insurance the same as homeowners insurance?

No. Park models are often insured under RV or specialty dwelling policies.

How long does a park model insurance claim take?

Simple claims may resolve in weeks, while larger repairs can take longer.

Do I need special coverage for weather damage?

Depending on the location, additional coverage for floods, wind, or storms may be required.

Can I choose my own repair contractor?

Usually yes, but always confirm with your insurer first.

Does insurance cover relocation during repairs?

Some policies include loss-of-use coverage; check your specific policy details.